Die Rockwell Forest Products, Inc. investiert 13$ Millionen durch Aktienkäufe in ExOne.

Rockwell Forest Products, Inc. ist im 100%igen Besitz von S. Kent Rockwell, dem CEO und Vorsitzendem von ExOne. Dieses Investment wird in Form von einem Kauf von 1.423.877 Aktien im Wert von je 9,13$ durchgeführt. Zum Zeitpunkt der Pressemeldung entspricht dies einem um 0,50$ höheren Preis als der Marktwert der Aktien.

S. Kent Rockwell:

“We believe customers, globally, are adopting our 3D printing technology and transforming their manufacturing processes at an accelerating rate, which is requiring ExOne to have the availability of additional working capital. I expect that these funds will provide the Company proper liquidity to meet our 2016 objectives of growth and profitable performance.”

Hier das komplette Press Release von ExOne:

ExOne Announces $13 Million Common Stock Investment by Chairman and CEO

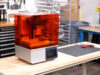

The ExOne Company (NASDAQ:XONE) (“ExOne” or “the Company”), a global provider of three-dimensional (“3D”) printing machines and 3D printed and other products to industrial customers, today announced that it has entered into a definitive agreement with Rockwell Forest Products, Inc. (“RFP”), an entity controlled by S. Kent Rockwell, Chairman and Chief Executive Officer of the Company, to raise approximately $13 million in gross proceeds in a registered direct offering of common shares. Estimated offering expenses of approximately $0.6 million will be deducted from the proceeds which, as a direct placement, are not subject to an underwriting discount or commission. The Company has agreed to sell 1,423,877 shares of its common stock (the “Shares”) to RFP for $9.13 per share, representing a $0.50 premium over the per share market price at the close of business on January 8, 2016 (the “Offering”), the last trading day preceding the Offering. The Offering is expected to close on or about January 13, 2016. The Company intends to use the net proceeds from the Offering for working capital and general corporate purposes. The sale to RFP was negotiated and approved by a committee of the Company’s Board of Directors consisting only of independent directors. In approving the sale to RFP, the independent committee was advised by an independent financial advisor and independent legal counsel.Effective as of the closing of the Offering, the Company will terminate its $15 million, five-year revolving credit facility (the “Credit Agreement”) with RHI Investments, LLC, an entity also controlled by S. Kent Rockwell, dated October 23, 2015. There are no borrowings outstanding under the Credit Agreement and, upon its termination, all liens and guaranties will be released. The termination of the Credit Agreement was approved by the credit facility committee of the Board, which also consists solely of independent directors.

S. Kent Rockwell commented, “We believe customers, globally, are adopting our 3D printing technology and transforming their manufacturing processes at an accelerating rate, which is requiring ExOne to have the availability of additional working capital. I expect that these funds will provide the Company proper liquidity to meet our 2016 objectives of growth and profitable performance.”

Upon completion of the Offering, Mr. Rockwell will beneficially own approximately 4.6 million shares of ExOne common stock, representing about 28.8% of shares outstanding.

The sale and issuance of the Shares is being made pursuant to a prospectus supplement dated January 11, 2016 filed by the Company with the Securities and Exchange Commission (the “Commission”), an accompanying prospectus of the Company which was filed with the Commission on May 4, 2015 (the “Prospectus”), and the Company’s existing shelf registration statement on Form S-3 (File No. 333- 203353), which was filed with the Commission on April 10, 2015 and declared effective by the Commission on May 1, 2015. Copies of the prospectus supplement and accompanying Prospectus may be obtained at the SEC’s website at www.sec.gov or from the Company at 127 Industry Boulevard, North Huntingdon, Pennsylvania 15642, Attn: Executive Vice President, Chief Legal Officer and Corporate Secretary.

This press release shall not constitute an offer to sell or a solicitation of an offer to buy any shares of common stock. No offer, solicitation or sale will be made in any jurisdiction in which such offer, solicitation or sale is unlawful.