Das deutsche Unternehmen ExOne (XONE) präsentierte am Mittwoch seine Ergebnisse für das 1.Quartal 2014. Der Umsatz betrug 7,3 Millionen Dollar und sank im Vegleich zum ersten Quartal im Jahr 2013 um 600.000 Dollar. Der Nettoverlust betrug 5,5 Millionen Dollar oder 38 Cent pro Aktie. Im ersten Quartal 2013 betrug der Nettoverlust noch 1,8 Millionen Dollar oder 20 Cent pro Aktie.

Eingroßes Wachstum gab es bei 3D gedruckten Produkten, Materialien und andere Services. Der Umsatz stieg von 3,7 auf 4,9 Millionen Dollar in diesem Bereich. Für 2014 erwartet das Unternehmen ein Umsatzwachstum von 40 bis 50 Prozent.

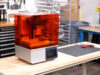

NORTH HUNTINGDON, Pa., May 14, 2014 (GLOBE NEWSWIRE) — The ExOne Company (Nasdaq:XONE) (“ExOne” or “the Company”), a global provider of three-dimensional (“3D”) printing machines and printed products to industrial customers, reported financial results today for the first quarter ended March 31, 2014.

First Quarter Revenue – Solid PSC Growth ($ in millions) March 31, 2014 2013 Revenue by Product Line 3D Printing Machines & Micromachinery $ 2.4 33% $ 4.2 54% 3D Printed Products, Materials and Other Services (“PSC”) $ 4.9 67% $ 3.7 46% Total Revenue $ 7.3 100% $ 7.9 100%

- Revenue for the quarter was $7.3 million

- PSC revenue was up 32% compared with the prior-year quarter

- The Company sold three 3D printing machines during the 2014 first quarter, consisting of one S-Max™ machine and one S-15™ machine sold to customers in Europe and one M-Flex™ machine sold to a U.S. customer

Given the long sales cycle and significance of a machine’s average selling price relative to total revenue, fluctuations in machine revenue may vary from quarter to quarter. ExOne does not believe that such quarter-to-quarter fluctuations are necessarily indicative of larger trends.

First Quarter Operations – Continued Investments

Gross profit was $1.6 million, or 22.2% gross margin in the 2014 first quarter, compared with $2.8 million, or 35.8% gross margin, in the 2013 first quarter. David Burns, President and Chief Operating Officer, commented, “Significant development costs associated with our ExCast strategy negatively impacted our gross margin for the quarter. Additionally, lower machine volume, combined with a higher cost base, unfavorably impacted absorption.”

Operating loss was $5.4 million compared with operating loss of $1.6 million in the first quarter of 2013. SG&A expenses were $5.2 million, compared with $3.6 million in the prior-year quarter. The current quarter included $0.2 million of expenses to support the Company’s pursuit of strategic acquisitions. R&D expenses for the quarter increased by $1.0 million to $1.8 million, resulting from ongoing materials qualification activities and machine technology enhancements. Net loss attributable to ExOne for the reported quarter was $5.5 million, or $0.38 per diluted share, compared with net loss attributable to ExOne of $1.9 million, or $0.20 loss per diluted share, for the prior-year period.

Adjusted earnings before interest, taxes, depreciation and amortization (“EBITDA”) was a $4.0 million loss in the 2014 quarter, compared with a $0.9 million loss during last year’s first quarter. ExOne management believes that when used in conjunction with other measures prepared in accordance with accounting principles generally accepted in the United States (“GAAP”), that Adjusted EBITDA, a non-GAAP measure, assists in the understanding of operating performance. See the attached tables for important disclosures regarding the Company’s use of Adjusted EBITDA as well as a reconciliation of net loss attributable to ExOne to Adjusted EBITDA for the quarters ended March 31, 2014 and 2013.

Outlook and Strategy – Updating 2014 Expectations

- Revenue expected to grow 40% to 50% in 2014, resulting in approximately $55 million to $60 million

- Gross margin now expected to be between 40% and 43% to adjust for first quarter actual results, excluding anticipated non-recurring costs estimated at $1.5 million to $2.5 million, associated with facility expansions

- SG&A expenses expected to be in a range of $19 million to $21 million

- R&D expenses expected to be in a range of $6 million to $7 million

- Capital expenditures expected to be between $31 million and $34 million, including investments for capacity expansion and a global ERP implementation.

S. Kent Rockwell, Chairman and CEO, noted, “We are enthusiastic over the increased level of activity in the 3D printing industrial manufacturing space and our position in it. Our customers and prospects are expressing increased interest about how our binder jetting technology can present new and innovative opportunities to enhance their businesses.”

He concluded, “We believe that nickel-based Inconel® alloy 625, recently introduced as our first single metal alloy providing more than 99 percent density expands our addressable market, especially in the aerospace, chemical and energy markets. To create additional opportunities for growth, we continue to work with customers to develop new metal material sets. And, with our expanded production capacity currently underway, we’ll be ready to respond as this market continues to grow.”

(C) Pictures & Info: ExOne