Das amerikanische “Tissue Engineering” Unternehmen Organovo Holdings, Inc (NYSE MKT: ONVO) verkündete heute die Q3 und 2014 Ergebnisse sowie ein Business Update.

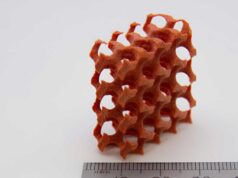

Organovo forscht an der Erstellung von künstlichen Gewebe und meldete vor kurzem Fortschritte bei der Entwicklung einer künstliche Leber.

SAN DIEGO, Feb. 7, 2014 /PRNewswire/ — Organovo Holdings, Inc. (NYSE MKT: ONVO) (“Organovo”), a three-dimensional biology company focused on delivering breakthrough 3D bioprinting technology, has reported its third quarter results and provided highlights of its recent activities.

Keith Murphy, chairman and chief executive officer of Organovo, commented on the results. “The quarter continues our progress throughout our scientific, operational and business development activities. Our progress in the development of 3D Liver tissues continues to be ahead of plan, highlighted by the demonstration of 40 days of characteristic liver activity and additional evidence of appropriate response to known hepatotoxic insults. We remain on-track for releasing our first commercial liver toxicity assay product later this calendar year,” Mr. Murphy stated. “Further, our new agreements are expected to assist in growing our commercial opportunities long term.”

Recent Highlights

- Announced collaboration with the National Center for Advancing Translational Sciences (NCATS) and the National Eye Institute (NEI), two institutes of the National Institutes of Health (NIH)

- Announced first delivery of 3D Liver tissue to Key Opinion Leader

- Released initial data on a 3D bioprinted human breast cancer tissue

- Achieved greater than one month performance for 3D bioprinted liver tissues

- Released additional data on its NovoGen Bioprinted 3D Liver demonstrating responsiveness to known toxins

- Announced a collaborative agreement in 3D skin tissues

On January 29th, the Company announced the first delivery of 3D Liver tissue to a Key Opinion Leader ahead of schedule, marking the achievement of a key milestone along the pathway to commercial launch of its 3D Liver tissue product.

On January 14th, the Company announced a collaboration with the National Center for Advancing Translational Sciences (NCATS) and the National Eye Institute (NEI) to develop better and more clinically predictive tissue models using Organovo’s NovoGen MMX Bioprinter®. The collaboration with these two institutes from the National Institutes of Health (NIH) will include use of the NovoGen Bioprinting platform to create three-dimensional, architecturally correct, functional living tissues to help scientists develop more reliable tools for bringing safer, more effective treatments to patients on a faster timeline.

On December 18th, the Company released initial data on a 3D bioprinted human breast cancer tissue for in vitro screening of therapeutics targeted against cancer progression, demonstrating that NovoGen bioprinted breast cancer tissues retain compartmentalized structures with interaction between stromal and cancer cells. Formation of endothelial networks and differentiation of adipocytes were observed in these tissues, and the constructs were demonstrated to be less susceptible to tamoxifen-induced toxicity than isolated 2D cancer cells when treated with the same dose of tamoxifen for the same duration, highlighting the potential utility of this model in identifying superior drugs with greater toxicity against complex, multicellular 3D tumor models.

On December 18th, the Company also released additional data on its NovoGen Bioprinted 3D Liver, citing evidence of the formation of tight junctions in the liver tissues as evidenced by claudin staining by day 3 of tissue formation. NovoGen Bioprinted 3D Liver tissues also showed additional evidence of appropriate response to hepatotoxic insults from acetaminophen, acetaminophen in combination with ethanol, and diclofenac.

On December 5th, the Company announced it had entered into an agreement to expand its current facility from approximately 15,000 to 30,000 sq. ft. to accommodate new collaborative agreement activities and expand manufacturing capacity for commercial launch of its first product.

On October 22nd, the Company announced achieving greater than one month performance and drug responsiveness for 3D bioprinted liver tissues, demonstrating that Organovo’s 3D Liver Tissue can potentially have value in assessing toxicology problems in human liver over a long period, including sub-acute and multiple dose efforts.

Financial Summary

A summary of the Company’s financial results for the third fiscal quarter follows, but is not intended to replace the full financial disclosure enclosed in the Quarterly Report on Form 10-Q the Company filed on February 6, 2014. Please reference that document for additional information. At December 31, 2013, the Company had total current assets of approximately $50.5 million and current liabilities of approximately $2.9 million, resulting in working capital of $47.6 million. At March 31, 2013, we had total current assets of approximately $16.1 million and current liabilities of approximately $8.4 million, resulting in working capital of $7.7 million.

Net cash used in investing activities was approximately $0.1 million and $0.4 million for the nine months ended December 31, 2013 and December 31, 2012, respectively. Net cash provided by financing activities increased from approximately $11.0 million provided during the nine months ended December 31, 2012 to $44.5 million provided during the nine months ended December 31, 2013. This increase was primarily due to the inclusion of $43.4 million in net proceeds from the issuance of common stock in August, 2013.

As of December 31, 2013, the Company had 77,424,956 total issued and outstanding shares of Common Stock, and five year warrants for the opportunity to purchase an additional 1,203,656 shares of Common Stock at exercise prices between $0.85 and $1.00 per share and 313,870 warrants with terms between two and five years and exercise prices between $2.21 and $7.36 per share. If all warrants were exercised on a cash basis, the Company would realize approximately $2.4 million additional gross proceeds. In aggregate, issued and outstanding common stock, shares underlying outstanding warrants, and shares reserved for the 2008 and 2012 incentive plans total 89,195,246 shares of common stock as of December 31, 2013.

Organovo is a development stage company, and does not expect product-based revenue until the commercial release of its liver toxicity assay product, currently planned to be before the end of November, 2014. Since inception, the Company has periodically received revenue from grants and collaborative research agreements. Revenue recognition from these sources, however, is intermittent and not necessarily indicative of the significance of the Company’s achievements related to those grants and partnerships.

Total revenues for the quarter of $0.1 million were $0.2 million or 67% below the approximately $0.3 million in revenues for the same period in 2012. Collaborative research revenues of less than $0.1 million decreased $0.2 million or 67% from the same period of prior year of approximately $0.3 million in revenues. This decrease reflects declining activity under an existing collaborative agreement and the conclusion of a previous collaborative research agreement during the quarter, partially offset by increasing revenue contributions from three recently signed agreements.

The Company doubled its research and development expenses during the quarter over the same period last year, while general and administrated expenses increased 14%. The Company has continued to prudently expand its scientific capabilities and resources, and increased its headcount from 29 full-time employees as of December 31, 2012 to 39 full-time employees as of December 31, 2013 to support its obligations under certain collaborative research agreements and to expand its product development efforts in preparation for product and research based service revenues. These staff increases resulted in increased staffing expenses of approximately $0.4 million or 34% over the same period in 2012. In addition, share-based compensation expense increased $0.6 million for the three months ended December 31, 2013 due to initial grants to new employees during the year and a significant increase in the Company’s stock price from December 31, 2012 to December 31, 2013. Total operating expenses increased approximately $1.5 million or 45% in the three months ended December 31, 2013 over the same period in 2012, from approximately $3.3 million in 2012 to $4.8 million in 2013.

The approximate $6.1 million decrease in other expense for the three month period ending December 31, 2013 compared to the same period of the prior year, was primarily related to the change in fair value associated with the warrants issued in our 2012 Private Placement financing. During the first quarter of calendar 2012, we issued warrants to purchase 6,099,195 shares of our common stock to the placement agent and warrants to purchase 15,247,987 shares of our common stock to investors in the Private Placement. The warrants issued to the placement agent and Private Placement investors were determined to be derivative liabilities as a result of the anti-dilution provisions in the warrant agreements that may result in an adjustment to the warrant exercise price. As a result of increasing stock prices during the three months ended December 31, 2012, the fair value of the derivative liability increased, resulting in the recognition of other expense of approximately $4.7 million. The majority of the underlying warrants have been exercised prior to December 31, 2013 or modified and reclassified as equity instruments. The increase in the fair value of the warrant liability during the three months ended December 31, 2013 was $0.6 million, which was recognized to other expense during the period. The Company will continue to revalue the derivative liability at each balance sheet date until the securities to which the derivative liabilities relate are exercised or expire. In addition, the Company completed a warrant tender offer in December 2012 to amend certain outstanding warrants to include a reduction of the exercise price of the warrants from $1.00 per share to $0.80 per share of common stock. In connection with the transaction, the Company recognized an expense for the inducement to exercise the warrants of approximately $1.9 million.

Link: Organovo