Das 3D-Technologie Unternehmen ExOne (XONE), präsentiert seine Ergebnisse für das 2.Quartal 2013.

Demnach soll der Umsatz des Unternehmens von $4,7 Mio. auf $9,2 Mio. gewachsen und die brutto Marge von 33% auf 45% gestiegen sein.

- Revenue increased by $4.5 million, or 97%, over prior-year second quarter

- Gross margin improved to 45%, from 33% in the second quarter of the prior year

- Second quarter net loss attributable to ExOne reduced to $1.1 million from last year’s second quarter $3.6 million net loss

- Company confirms 2013 guidance at lower end of revenue range and higher end of gross margin range

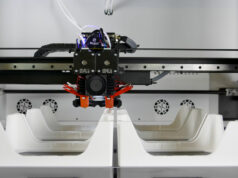

NORTH HUNTINGDON, Pa., Aug. 13, 2013 (GLOBE NEWSWIRE) — The ExOne Company (Nasdaq:XONE) (“ExOne” or “the Company”), a global provider of three-dimensional (“3D”) printing machines and printed products to industrial customers, reported financial results today for its 2013 second quarter, which ended June 30, 2013.

Revenue for the second quarter of 2013 was $9.2 million compared with revenue of $4.7 million for the second quarter of 2012, an increase of $4.5 million, or 97%. Net loss attributable to ExOne for the second quarter of 2013 was $1.1 million, or $0.08 per diluted share, compared with a net loss attributable to ExOne of $3.6 million for the second quarter of 2012, an improvement of $2.5 million.

Revenue Growth—Driven by Stronger Sales of 3D Printing Machines ($ in millions) For the Quarter Ended June 30, 2013 2012 Revenue by Product Line 3D Printing Machines and Micromachinery $5.8 63.0% $1.5 31.9% 3D Printed Products, Materials and Other (“PSC”) $3.4 37.0% $3.2 68.1% Total Revenue $9.2 100.0% $4.7 100.0% During the second quarter of 2013, machine revenue was $5.8 million. Four S-Max™ platform machines, the largest of the Company’s 3D printing machines, were sold in the quarter. One machine was sold to customers in each of Japan, India, Russia and the U.S. and machine revenue represented 63% of total revenue in the 2013 second quarter. One S-Max™ machine was sold in the prior-year second quarter.

Production Service Center (“PSC”) revenue for the 2013 second quarter was approximately $3.4 million, up 6%, or $0.2 million, over the prior-year second quarter. PSC revenue represented 37% of total revenue in the 2013 second quarter.

Reduced Operating Loss—Driven by Machine Sales Volume

Gross profit was $4.2 million in the second quarter of 2013, an improvement of $2.7 million compared with gross profit of $1.5 million in the second quarter of 2012. Gross profit as a percent of sales was 45.3% in the second quarter of 2013 compared with 32.6% in the second quarter of 2012. Gross profit and gross margin for the second quarter of 2013 improved on volume, favorable sales mix and enhanced productivity in the Company’s PSCs.

Operating loss for the second quarter of 2013 was $1.0 million compared with an operating loss of $3.1 million in the second quarter of 2012, an improvement of $2.1 million. Selling, general and administrative (“SG&A”) expenses for the second quarter of 2013 were $3.9 million, compared with$4.3 million in the prior-year second quarter. The 2012 second quarter SG&A included a $1.8 million equity-based compensation charge. Research and development (“R&D”) expenses for the second quarter of 2013 increased by $0.9 million to $1.3 million, in support of the Company’s materials qualification and machine technology enhancements.

Adjusted earnings before interest, taxes, depreciation and amortization (“EBITDA”) was a loss of $0.3 million in the second quarter of 2013, improved from a loss of $2.7 million in the second quarter of 2012. ExOne management believes that when used in conjunction with other measures prepared in accordance with accounting principles generally accepted in the United States (“GAAP”), that Adjusted EBITDA, a non-GAAP measure, assists in the understanding of operating performance. See the attached tables for important disclosures regarding the Company’s use of Adjusted EBITDA as well as a reconciliation of net loss attributable to ExOne to Adjusted EBITDA for both the quarter and six-month periods ended June 30, 2013 and 2012.

First Half 2013 Review—Demonstrates Favorable Momentum

Revenue for the six-month period ended June 30, 2013 was $17.2 million, up $9.8 million, or 132%, compared with $7.4 million in the prior-year period, driven primarily by machine sales as well as growth in PSC revenue globally.

First half gross profit was $7.0 million, up $4.7 million compared with the last year’s first half of $2.3 million. Gross profit as a percentage of sales improved to 40.9% in the first half of 2013, a 930 basis point improvement over 31.6% in last year’s first half. SG&A expense for the first six months of 2013 was $7.5 million, up $1.6 million from the prior-year period. R&D expense was $2.1 million in the first half of 2013, compared with $0.8 million in the first half of 2012, reflecting the Company’s investments in growth.

Operating loss for the first half of 2013 was $2.6 million, improved from a loss of $4.4 million during the comparable prior-year period. Net loss attributable to ExOne was $3.0 million, or $0.27 per diluted share, for the first half of 2013 compared with $5.1 million for the first half of 2012.

Strategy and Outlook

Mr. S. Kent Rockwell, Chairman and CEO, noted, “We believe our results continue to demonstrate the effective execution of our growth strategies. We are increasing machine sales, expanding our PSC network and building our material and binders portfolio. We believe ExOne remains distinctively positioned as a leading industrial provider of 3D printing machines and printed products, and we expect demand to continue to increase.”

The Company anticipates that its 2013 revenue will be at the lower end of its previous guidance of $48 million to $52 million. The Company’s expectations are based on no additional micromachine (laser drilling machine) sales in 2013 and timing of year-end shipments. Further, the weakening of the Japanese yen relative to the U.S. dollar has impacted full year revenue expectations. ExOne anticipates that its 2013 gross margin will be at the higher end of its previous guidance of 42% to 46%. Lastly, ExOne expects 2013 operating expenses to be at the upper end of its previous guidance of$18 million to $21 million.

Approximately $40 million to $50 million in growth investments for manufacturing capacity and PSC development are planned for 2013 and 2014. This includes approximately $20 million for the recently announced expansion and consolidation of the Company’s German operations.

via ExOne